Imagine waking up to find your trading account has made profitable trades while you slept. That’s the power of forex trading automation with AI—a technology that’s transforming how traders approach the $7.5 trillion daily forex market

In this guide, you’ll discover how artificial intelligence is revolutionizing automated trading, the tools available today, and whether AI-powered forex automation is right for your trading strategy.

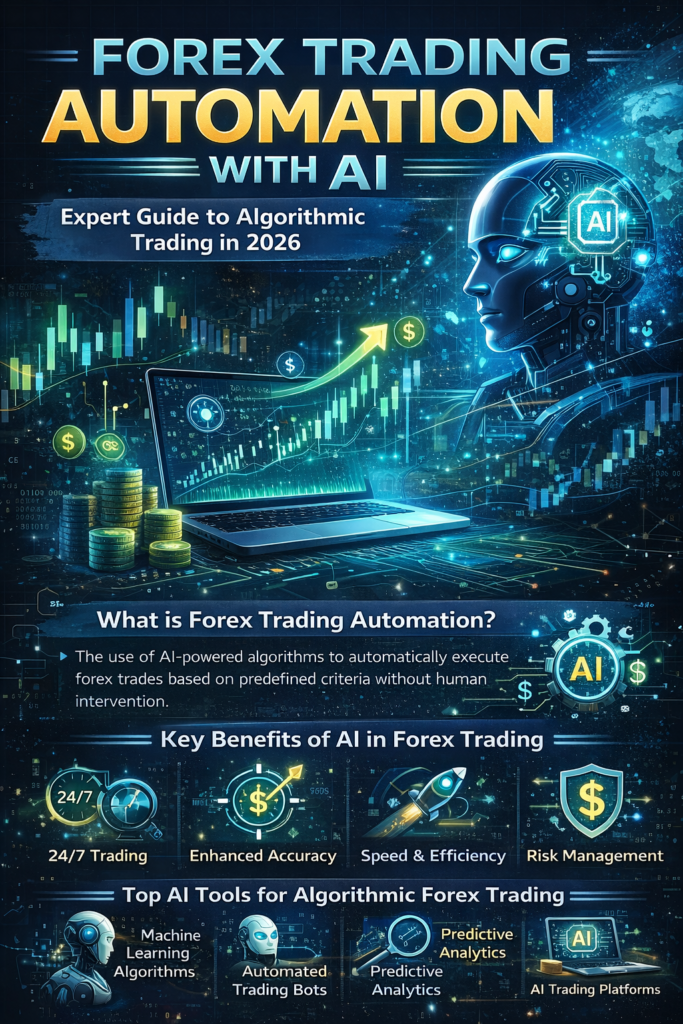

What Is Forex Trading Automation with AI?

Forex trading automation with AI combines algorithmic trading systems with artificial intelligence to analyze markets, identify opportunities, and execute trades automatically—without constant human supervision.

Traditional automated trading follows rigid, pre-programmed rules. AI takes it further by:

- Learning from market patterns using machine learning algorithms

- Adapting to changing conditions without manual reprogramming

- Processing massive data sets in milliseconds

- Reducing emotional trading decisions that hurt profitability

Think of it as having a tireless trading assistant that never panics, never sleeps, and continuously improves its strategy based on what works.

How AI-Powered Forex Trading Automation Works

AI forex systems operate through four core stages:

1. Data Collection and Analysis

AI algorithms scan multiple data sources simultaneously:

- Real-time currency price movements

- Economic indicators and news feeds

- Historical trading patterns

- Market sentiment from social media and reports

This comprehensive analysis happens faster than any human trader could manage.

2. Pattern Recognition with Machine Learning

Machine learning models identify profitable trading patterns by:

- Analyzing thousands of past trades

- Recognizing subtle correlations humans might miss

- Calculating probability of success for different scenarios

- Updating predictions as new data arrives

3. Automated Trade Execution

Once the AI identifies an opportunity that meets your parameters, it:

- Opens positions at optimal entry points

- Sets stop-loss and take-profit levels automatically

- Manages multiple currency pairs simultaneously

- Executes trades in milliseconds to capture the best prices

4. Continuous Learning and Optimization

Unlike static trading bots, AI systems improve over time by:

- Evaluating which strategies performed best

- Adjusting algorithms based on wins and losses

- Adapting to new market regimes

- Refining risk management rules

Top Benefits of Using AI for Forex Trading Automation

Trade 24/7 Across Global Markets

The forex market never sleeps, operating 24 hours across different time zones. AI automation ensures you never miss trading opportunities—even when you’re sleeping, working, or on vacation.

Eliminate Emotional Decision-Making

Fear and greed destroy more trading accounts than bad strategies. AI removes emotions from the equation, sticking to proven rules without second-guessing or revenge trading after losses.

Process Information Faster Than Humanly Possible

AI can analyze hundreds of technical indicators, news events, and chart patterns across dozens of currency pairs in seconds. This speed advantage is crucial in fast-moving forex markets.

Backtest Strategies with Historical Data

Before risking real money, AI systems let you test strategies against years of historical data to see how they would have performed in different market conditions.

Scale Your Trading Without Added Effort

Managing multiple currency pairs and strategies manually is exhausting. AI handles complex multi-strategy portfolios effortlessly, freeing your time while potentially increasing returns.

Best AI Tools for Forex Trading Automation in 2025

Several platforms now offer forex trading automation with AI capabilities:

MetaTrader 4/5 with AI Expert Advisors

The most popular forex platforms support custom AI-powered Expert Advisors (EAs). Many developers offer AI-based EAs that use neural networks and machine learning.

Best for: Traders who want customization and control over their AI strategies.

Proprietary AI Trading Platforms

Platforms like Trade Ideas, Kavout, and TrendSpider integrate AI directly into their systems, offering:

- Pre-built AI trading strategies

- Real-time pattern recognition

- Automated signal generation

- Risk management tools

Best for: Traders who prefer ready-made solutions without coding.

Copy Trading with AI-Selected Traders

Services like eToro and ZuluTrade now use AI to identify and recommend top-performing traders to copy, analyzing their consistency, risk levels, and strategy effectiveness.

Best for: Beginners who want to leverage others’ expertise with AI assistance.

Risks and Limitations to Consider

While forex trading automation with AI offers significant advantages, it’s not a guaranteed path to riches:

Over-Optimization (“Curve Fitting”)

AI systems can become too perfectly tuned to past data, performing brilliantly in backtests but failing in live markets. Always test strategies on out-of-sample data.

Technology and Connectivity Risks

Automated systems depend on:

- Stable internet connections

- Reliable broker execution

- Proper software maintenance

- Regular monitoring for errors

A technical glitch at the wrong moment could lead to unexpected losses.

Market Conditions Change

AI learns from historical patterns, but unprecedented events (like central bank surprises or geopolitical shocks) can cause strategies to underperform until the system adapts.

Not a “Set and Forget” Solution

Even the best AI systems require:

- Regular performance monitoring

- Periodic strategy adjustments

- Risk parameter updates

- Understanding of how your system works

Blindly trusting any automated system is dangerous.

Getting Started with AI Forex Trading Automation

Ready to explore AI-powered forex automation? Follow these steps:

1. Education First

Learn forex basics, technical analysis, and risk management before automating anything. Understanding what your AI is doing is crucial.

2. Start with Demo Accounts

Test AI trading systems with virtual money first. Most platforms offer free demo accounts where you can see how automation performs without risk.

3. Choose Reputable Platforms and Tools

Research broker regulation, user reviews, and track records. Avoid systems promising unrealistic returns or “guaranteed profits.”

4. Begin with Conservative Settings

Use lower risk per trade (1-2% of account) and conservative position sizing until you understand how your AI system behaves.

5. Monitor and Adjust Regularly

Check your system’s performance weekly. Review trades, analyze drawdowns, and make gradual improvements based on results.

FAQ: Forex Trading Automation with AI

Can AI Really Make Money in Forex Trading?

AI can identify profitable patterns and execute trades efficiently, but it’s not magic. Success depends on the quality of the AI system, proper risk management, and realistic expectations. Many traders achieve consistent results with AI, but losses are still possible.

How Much Money Do I Need to Start AI Forex Trading?

You can start with as little as $100-$500 on many platforms, though $1,000+ gives you better position-sizing flexibility. Focus on learning and consistent returns rather than account size initially.

Do I Need Coding Skills for Forex Trading Automation with AI?

Not necessarily. Many modern platforms offer no-code AI trading tools with visual strategy builders. However, coding knowledge (like Python or MQL) gives you more customization options.

Final Thoughts: Is AI Forex Automation Right for You?

Forex trading automation with AI represents a powerful evolution in currency trading—offering speed, consistency, and emotion-free execution that manual trading can’t match.

It’s ideal if you:

- Want to trade markets 24/7 without constant monitoring

- Struggle with emotional discipline

- Enjoy technology and data-driven approaches

- Have realistic expectations about returns and risks

However, it’s not a replacement for education, risk management, or strategic thinking. The most successful traders use AI as a tool to enhance their edge—not as a magic solution.

Start small, learn continuously, and let AI handle the heavy lifting while you focus on strategy and risk management. The future of forex trading is here, and it’s more accessible than ever.

Ready to explore AI forex trading? Start by opening a demo account with a regulated broker that supports automated trading, and test different AI strategies risk-free before committing real capital.

Leave a Reply